Note: This post is 2-3 times the length of a typical post so you may need to click “view entire message” in your email client to see the whole thing. Also, the post cadence has changed as I’ve been taking it easy this summer.

Really big effects, lollapalooza effects, will often come only from large combinations of factors.

-Charlie Munger

Famed investor Charlie Munger uses over one hundred mental models to evaluate opportunities, one of which he calls "lollapalooza effects". Lollapalooza effects are exhibited when components and mechanisms that are highly interactive, create complex behavior. These interactions alter behavior such that not considering each of the individual components in combination produces wildly different results. In his own words:

Lollapalooza tendency - the tendency to get extreme consequences from confluences of psychological tendencies acting in favor of a particular outcome.

However, the lollapalooza tendency doesn't apply to only psychological factors, it applies whenever a multitude of factors affect a complex system. Within complex systems, failures tend to be interconnected. When things go bad, other things go bad as well, and the decision making environment shifts. What you thought you could rely on in a failure might be overstressed and fail as well. When one system fails, the effects can cascade, causing other systems to fail as well. You might normally have a backup plan but can it withstand multi-system or complete system failures? Think about a bank run. You think if the economy starts tanking, I'll just pull my money out of the bank so that I have cash on hand. However, if everyone thinks like this then the bank closes its doors and you can't get your money out because they don't have enough immediate assets on hand to service everyone. You can review the 2023 collapse of Silicon Valley Bank for a reminder of how this can happen along with the connected system fallout.

Keep these ideas in mind as today, we face a perfect storm of challenges that, when combined, create a world far more chaotic and unpredictable than most are prepared for. Consider this story of a dog in a convenience store. A man walks in to a convenience store and sees a dog groaning on the floor. The man asks the store owner why the dog is groaning. The shop owner tells him that the dog is laying on a nail. "Why doesn't he move?" asks the man. The shop owner replies, "it doesn't hurt him enough to move". This parable perfectly encapsulates our current global predicament: we're aware of the mounting problems, but the pain isn't yet acute enough to spur decisive action.

We stand at a critical juncture where five interrelated forces are reshaping our world: climate change, infrastructure decay, artificial intelligence advancements, growing social disorder, and shifts in the global monetary system. Each on its own presents significant challenges, but their interactions create a lollapalooza effect that demands our immediate attention. Let's examine how these forces interplay and amplify each other, creating a web of complexity that threatens the stability of our global systems.

Climate

At the heart of our global challenges lies climate change, acting as a catalyst that exacerbates and accelerates other problems. At this point it has become pretty apparent that the world will blow past the Paris Accord hope of restricting global warming to 2 degrees Celsius. Restricting to 3 degrees Celsius is now the optimistic scenario. It bears repeating that while this summer is looking to be very hot and setting record breaking temperatures, it will be the coolest summer that you will experience for the rest of your life. Let's look at how surface temperatures anomalies are comparing:

Figure 1. Surface temperature anomalies colored by year

For roughly the past 140 years, the temperature across every month has been generally increasing (when taken in 20 year blocks as colored in the figure above). This makes large parts of the world much harsher to live in. These higher temperature conditions also wreak havoc on crop production. ProPublica put out a study that showed how much crop yields could be reduced in the next 15 to 30 years. Some parts of the US are expected to lose as much as 92% of their crop yields! Note that this map is just for the US, which is in a much better position than more tropical climates. Here's the interaction effect - 80% of crops and farm land are used for livestock. If crop yields in these areas are greatly reduced, it decreases the amount of meat and dairy supply and increases consumer costs due to lower supply of meat, feed, and increased transportation costs.

Figure 2. Change in estimated crop yields in 2040-2060. Courtesy of ProPublica.

The social impact of rising temperatures is typically overlooked. Did you know that higher than baseline temperatures cause people to be more aggressive and violent? There are also several studies showing how temperature increases above normal cause violent crimes to rise. Even anecdotally, imagine how much more irritable you are when you are very hot.

Climate change doesn't just affect our environment; it ripples through every aspect of our society, economy, and geopolitics. It strains our infrastructure, fuels social unrest, and challenges our economic systems. As we delve into the other forces at play, we'll see how climate change acts as a threat multiplier, amplifying the challenges in each area.

Infrastructure

Our infrastructure, the silent backbone of society, is showing its age and vulnerability in the face of climate change. You don't worry about having a bridge to cross the river, electrical power, or access to clean drinking water until suddenly it is no longer available. You need only look at recent events from power outages due to hurricanes, a major bridge collapse, to water quality issues, to dam failures in order to understand the importance of infrastructure and what happens when it disappears.

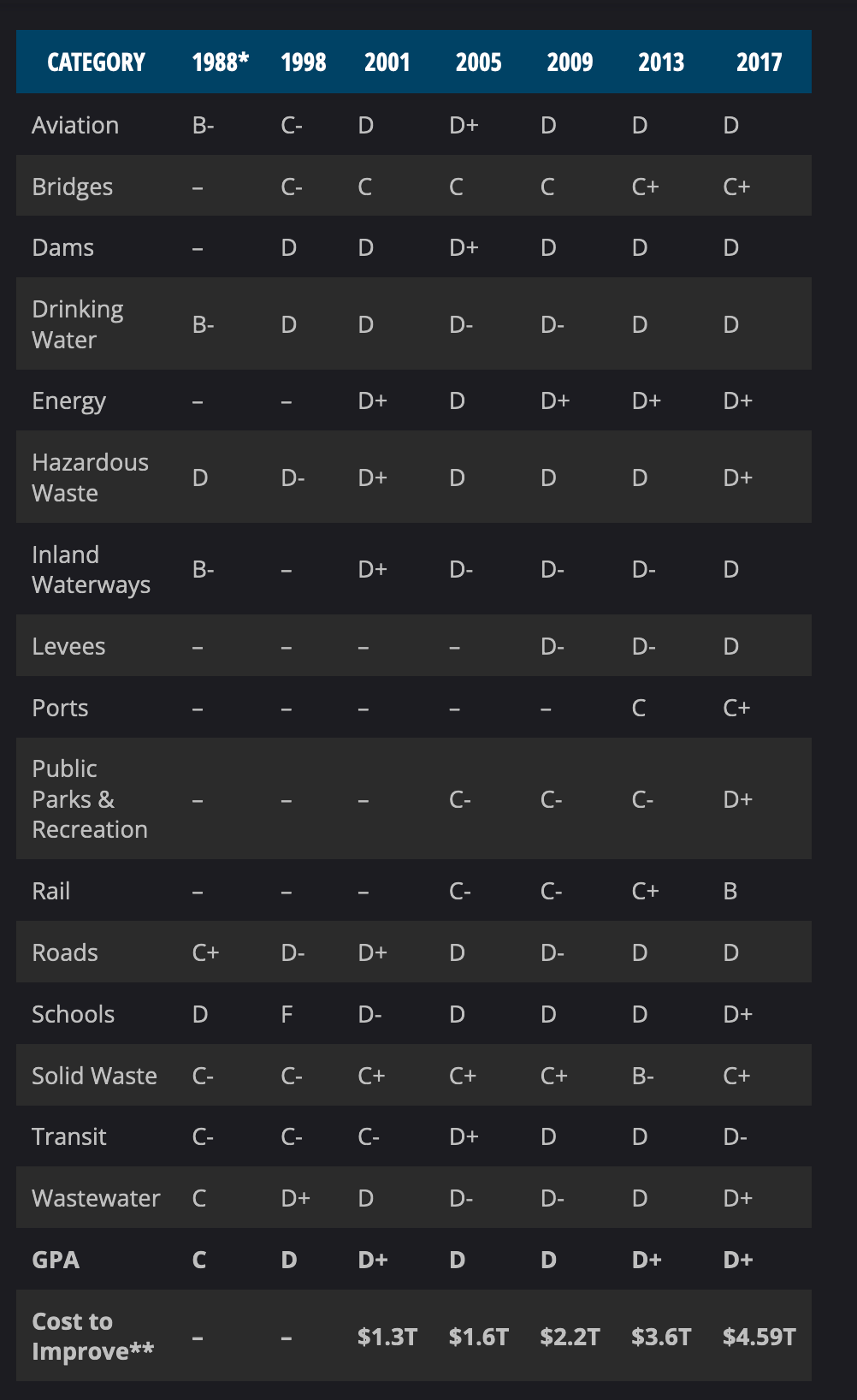

Every four years, the American Society of Civil Engineers (ASCE) puts out a report card for the current state of infrastructure in the US. The reports are dismal and most areas tend to be on the decline. You can view the most recent report cards below. While everyone agrees infrastructure is important, it is expensive to continuously maintain and to build new. The total cost to bring infrastructure up to snuff is measured in the trillions of dollars

Figure 3. ASCE 2021 report card on American infrastructure

Figure 4. Historical ASCE report card on American Infrastructure

Most infrastructure is built for a 50-100 year lifespan. Those lifespans are routinely exceeded due to the costs of repairs or replacement. This results in increased fragility of our infrastructure. Additionally, the design parameters of a given piece of infrastructure are typically based on historical or predicted maximums (wind, temperature, energy demand, rain, etc) along with a safety factor. Designs also take into account the probability of failure along with the impact of a failure. However, due to climate change more extreme events are occurring. The probability distributions, upon which old infrastructure was originally designed, are shifting. Extreme events that used to be considered 100 year events are now becoming 10 year, 5 year, or even 1 year events. The Sword of Damocles is hanging over our infrastructure as load demand increases well beyond expectations and capacity dwindles. Expect the frequency of failures to increase.

We need to be proactive in replacing and repairing infrastructure. Infrastructure takes a long time to repair and an even longer time to replace. Unexpected replacement can be especially impactful. It typically takes one to two years at a minimum to rebuild failed infrastructure. Are you able to go that long without a consistent source of power, water, or transportation?

Infrastructure decay doesn't just inconvenience us; it threatens the very foundations of our society and economy. Failing infrastructure can disrupt supply chains, hinder economic growth, and in extreme cases, costs lives. Moreover, the enormous cost of infrastructure renewal strains public finances, creating ripple effects throughout our economic and social systems. At the same time, the mere act of producing materials like steel and concrete for these projects generates significant emissions, creating a paradox where efforts to improve infrastructure exacerbate climate issues.

AI

People underestimate AI and have been routinely incorrect on how fast it is progressing. I've done it myself, even as a deep practitioner in this area. Part of this is because it is difficult to think exponentially and to predict when breakthroughs will happen. Figure 5 compares images created by Midjourney two years apart. You can find more from June-Hao Hou here.

Figure 5. The difference between Midjourney prompts two years apart

AI is a promise of infinite flexibility in solving problems, which has led to massive hype of its potential. It automates decision making and creates outputs at a very fast rate. While generative AI tends to raise the bar from average to good, it cannot create the best. At the moment, machine learning and AI systems are much better at interpolation than extrapolation. (If you're interested in knowing how I think they can surpass this, reach out.)

While AI promises solutions to complex problems, including climate modeling and infrastructure optimization, it also introduces new challenges. The energy demands of AI are staggering. As models grow in size and complexity, they strain our already fragile infrastructure and contribute to climate change. This creates a feedback loop where the very technology we hope will solve our problems may be exacerbating them.

AI models currently improve through scaling laws. That is, we can improve the performance of models by increasing the size of the models. However, to do that in an efficient manner requires larger amount of data, compute, and energy. Some believe that we can scale our way to AGI (artificial general intelligence). For reference, the global worldwide electrical generation in 2021 was 28,548 Terawatt-hours, about a capacity of 3.3 Terawatts at any given moment or 79.2 Terawatt-hours per day. For reference, LLama 3-70B (one of Meta's large open-source models) took about 6.4M GPU hours to train at 700W per GPU. That comes out to approximately 0.5 Terawatt-hours required to train the model. Remember that's just a single training run and doesn't include other models, iterations, or testing. Meta also isn't the only one training models; Google, OpenAI, Anthropic, Mistral, 01.AI, and others are all training large models. This electrical load is enormous.

However, there are energy limits. The human brain runs at about 20W, which is several orders of magnitude lower than what it takes to run inference on a LLM, let alone train one. Until AI is made more efficient, the limit to which AI model performance can grow will be limited by the amount of available energy. This also provides an upper bound on how much AI can be used and integrated across the entire ecosystem.

Still more concerns exist regarding the future of AI and its role in society. AI's potential to automate many jobs threatens to exacerbate social inequality and unrest. The concentration of AI capabilities in a few tech giants raises concerns about the centralization of power. As AI becomes more integrated into critical systems like healthcare and finance, it introduces new vulnerabilities and ethical dilemmas.

Social Disorder

The compounding effects of climate change, infrastructure decay, and technological disruption are taking a toll on our social fabric. Despite crime levels decreasing in many areas, people feel more anxious and fearful than ever. Social media and hyper-connectivity amplify negative events, creating the perception of constant threat. This disconnect between reality and perception fuels social tension and political polarization.

Figure 6. The change in crime rates over time

Ray Dalio, the founder of one of the best performing hedge funds, Bridgewater Associates, recently released an analysis of the current state of both US and World orders. He titled it "Pick a Side and Fight for It, Keep Your Head Down, or Flee".

When I wrote my book, Principles for Dealing with the Changing World Order, which looked at the rises and declines of domestic and world orders over the last 500 years, I chronicled the six stages of the “big internal order cycle,” their symptoms, and the cause-effect relationships that drive them. Just like life cycles, these stages are logical and everyone goes through them, typically about once in a lifetime. Toward the end of the cycle, which is where all the signs and symptoms show us to be today, people typically face a choice between fighting for one side or another, keeping their heads down, or fleeing.

When I wrote the book in 2020, I saw the writing on the wall but had hoped for the possibility that we would not cross the brink into a type of civil war, so I estimated the chance of that as about 1 in 3. At the time, this was considered a crazy high estimate (this was before the 2020 election being contested and the January 6th incident). Now I think the risk of some form of civil war is uncomfortably more than 50 percent, and I am confident that in the next year we will know the answer to whether we will cross the brink.

That's quite a scary proposition. For reference here is Ray Dalio's cycle of an Empire:

Figure 7. Ray Dalio's empire cycle

A large amount of social unrest can be attributed to wealth inequality. A good measure for wealth inequality is the Gini coefficient. A Gini coefficient of 0 represents perfect income equality while a coefficient of 1 represents perfect inequality. Below is an illustration of the formula and how it works. Realize that the Lorenz curve is non-linear, so small differences in values can lead to large real-life differences in economic equality.

Figure 8. How the Gini coefficient works

Where does the US stand compared to other countries in terms of the Gini index? Looking at the table from the World Bank, the US is ranked 113 out of 168 countries, among the bottom third of all countries in the world.

Figure 9. Where the US stands in terms of economic inequality

Digging deeper we can see that from the 1960s until 1980 results in a drop in of the Gini coefficient (improved economic equality). Since 1980, the Gini coefficient has been mainly been increasing (growing inequality).

Figure 10. The change in the US Gini coefficient over time

The potential displacement of workers due to AI and automation, coupled with the stress of climate change and failing infrastructure, could further intesify these tensions. As people compete for increasingly scarce resources, the risk of conflict - not just one war, but potentially many - looms on the horizon.

This increased social disorder, in turn, makes it more difficult to address our other challenges. Political polarization hinders effective policymaking on climate change and infrastructure renewal. Social unrest disrupts economic activity and strain public resources, creating a vicious cycle of instability.

Monetary System

Underpinning all of these challenges is the global monetary system, which is showing signs of strain. For decades, the US dollar has reigned as the world's reserve currency, providing significant advantages to the American economy. However, this dominance is eroding, adding another layer of uncertainty to our already volatile world.

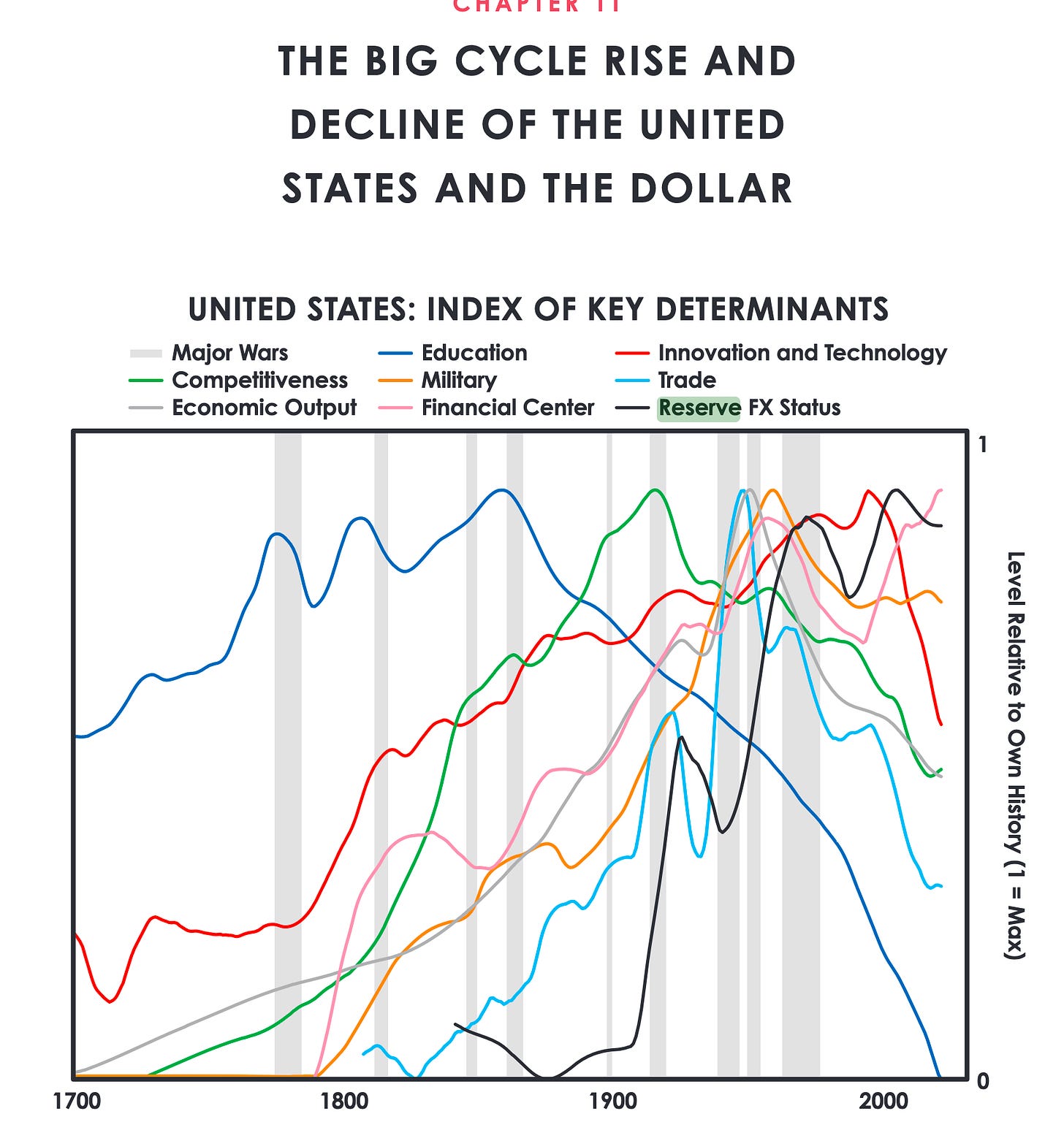

Through the past 500 years or so of history (Figure 11 below), the world has been dominated by a single empire. Whichever empire was in power also had the power of being the reserve currency. Being the reserve currency means that all other countries are willing to transact in that currency and hold reserves of it in their central banks. This is a superpower because the country holding the reserve status can both borrow at lower interest rates, given the status of the currency, and it can issue more of the currency, effectively paying off its debts to other countries for free. Since the Bretton Woods Conference of 1945, the United States has been the world's reserve currency.

Figure 11. The arc of various world empires over time. Courtesy of Ray Dalio.

Figure 12. How different key determinants of the US empire have changed over time. Courtesy of Ray Dalio.

Recently, the status of the US dollar as the reserve currency has been challenged. The most impactful challenge was related to the linkage between crude oil and the US dollar, dubbed the petrodollar. The petrodollar was an agreement whereby Saudi Arabia agreed to conduct all oil transactions in US dollars and invest surplus funds in US Treasures in exchange for military support. Recently, Saudi Arabia declined to continue the 50 year agreement. The decline of the petrodollar system and efforts by other countries to reduce their dependence on the US dollar threaten this status quo. A shift away from US dollar dominance could create a more multi-polar and volatile global financial system, making international trade and investment more challenging.

Combined with the other challenges and forces, a weakening US monetary position could severely limit America's ability to address issues like infrastructure decay, climate change, and social disorder. It could also accelerate the development of AI by other nations, potentially shifting the balance of technological power.

Moving Forward

Movement. That's the one word to describe how the confluence of the above factors will affect our world. Movement away from the environments, structures, and systems we know into areas about which we have less knowledge. Movement of money away from where we want it to places that need it. Movement of power to new and unfamiliar places. What's obvious is, if you think you can continue to do things the way you always have, you're likely in for a big surprise.

How do all of these factors affect each other? Where does the lollapalooza occur? Here's a few considerations for how these forces interact:

Climate change accelerates infrastructure decay, which strains public finances and potentially weakens the position of the US dollar due to the additional debt required.

A weakened dollar limits the ability of the US to invest in both climate mitigation and infrastructure renewal.

While offering potential solutions to climate and infrastructure challenges, AI also consumes vast amounts of energy, potentially exacerbating climate issues.

AI's rapid advancement threatens job displacement, potentially fueling social unrest and further straining public resources.

Social disorder, driven by inequality and fear of the future, makes it harder to achieve the global cooperation necessary to address climate change and to manage the transition to new economic paradigms brought about by AI. It also reduces economic productivity.

The confluence of these factors creates a world of increasing volatility, where our traditional ways of thinking and decision-making may no longer suffice. We're moving away from familiar environments, structures, and systems into uncharted territory. Yet, despite the dark seas ahead, there are potential paths forward:

Embrace Adaptability: Given the rapid pace of change, prioritize continual learning and diversification of skills.

Plan for Optionality: When things go wrong or multiple failures happen, you can't count on the same resources and services being available that you could in normal times.

Build Resilience: Both personally and societally, focus on building systems that can withstand shocks and recover quickly.

Proactive Adaptation: Instead of waiting for the pain to become unbearable, like the dog on the nail, we must proactively adapt to our changing world.

Systems Thinking: Recognize the interconnections between different challenges and developing solutions that address root causes rather than symptoms.

Long-term Perspective: Move beyond short-term fixes to develop strategies that ensure long-term sustainability and resilience.

The lollapalooza effects of climate change, crumbling infrastructure, AI advancement, social upheaval, and monetary instability are not looming threats – they're our current reality. The interconnected nature of these challenges means that when one component begins failing, cascading failures across all systems may follow swiftly. Our task now is not only to solve individual problems, but to also navigate a world where multiple systems are simultaneously under extreme stress. Adaptation, resilience, and systems thinking are no longer optional – they're survival skills in this new landscape. As we move forward, we must recognize that our old maps are obsolete. In uncharted territory, it will be our ability to anticipate, adapt, and act decisively in the face of uncertainty that will determine whether we merely survive or thrive.